A construction contractor needs to aggressively manage the amount of cash coming in and going out i.e. he needs to balance cash receipts and payments. When a contractor loses control of his cashflow and has to delay payments to sub-contractors and suppliers, he is in effect triggering a chain of events which will affect the entire project’s outcome.

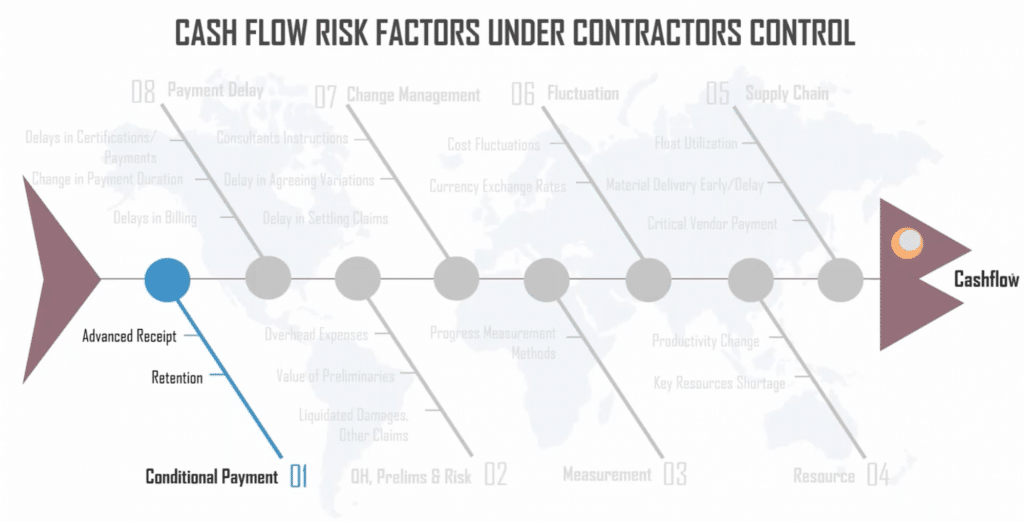

We’ve identified eight risk factors, filtered out of the RICS* master list, which can and should be controlled by contractors to successfully deliver a project.

Risk factor 1/8: Delayed Conditional payment due to lack of ready documentation

Conditional payment, as the name suggests, is payment linked to certain pre-agreed conditions.

Every country has its own laws governing conditional payment contracts and clauses, but the broad intent of all is that a conditional payment clause is written into a contract to assist in construction work going forward as smoothly as possible. For example, a general contractor may have in his contract with a project owner a clause that conditions payment of subcontractors on receiving payment from the project owner.

There are two broad types of conditional payments – Advance Payments and Retentions.

Advance Payments are made at the beginning of the projects, recorded as Prepaid Expenses and shown as assets on the balance sheet (of client). The purpose of an Advance payment is to help contractors meet their upfront cash needs during project start up. An Advance payment is conditional in that processing it means working with banks, which means a lot of documentation, and if any part of the documentation is insufficient or delayed – as frequently happens – the payment does not get processed in time, which is a huge challenge to cash-strapped contractors desperately trying to get the work off the ground. In most cases, the contractor has to provide some form of collateral, usually in the form of an Advance Payment Bank Guarantee, but even this can get delayed at the contractor’s side.

By contrast, Retention is linked to actual, and ‘provable’, work progress. In India, approximately 12% of the project cost is typically held in retention. Retention amounts are reduced from contractor’s monthly invoices/ interim payment certificates and is partially released after substantial project completion. The balance is released after project is completely taken over by the End-User.

Delay in either an advance or a retention payment can be disastrous, in different ways.

A delayed advance payment can prevent the start of a project, which is like starting off on the wrong foot, while delayed retention payments impact ongoing work and payments to subcontractors and vendors, setting off a domino-type effect. Unfortunately, the reality is that most contractors see delays in both.

What can contractors do to avoid delayed retention payments?

Documentation is the key.

Retention payments rely heavily on the submission of the required documentation. Since retention amounts are linked to the fulfilment of certain agreed-upon conditions, like submission of Work Completion Packs, O&M Manuals, etc., contractors need the necessary documentation proving the fulfilment of those conditions ready to hand, ideally before the prescribed deadline. That way, payments will get streamlined, and so will the project cash flow.

How SmartProject helps decrease the risk of delayed conditional payments.

In SmartProject, maintaining documents is very easy.

In a non-digitized project, work is tracked manually, and errors and rework are common, and sadly, documentation is sometimes an afterthought or even created retroactively ‘after the fact’. While this cannot be helped in a project that is driven by human effort and uses multiple siloed software (like AutoCAD, MsExcel, MsProject, Primavera, and the like), opting to ‘digitize’ the project cycle and using a system like SmartProject helps the contractor remove his primary bottleneck in document management (lack of integration) and solves the problem of delayed payments at the source.

How it works

SmartProject has system-generated Checklists and Workflows which every project engineer has to follow, and this ensures that all the prescribed documentation gets created by default as work progresses, which in turn allows managers to track, and if required correct, the documentation in ‘real time’, so that presenting the documentation to the client for approval or signoff becomes a simple formality, rather than a reason to panic.

During implementation, templates are set up in the various software systems used by the project team (and these software systems are linked within SmartProject), which ensures that work progress is correctly logged and recorded and can be retrieved in a matter of minutes when required.

To sum up, SmartProject sets up an integrated document management system which not only records all the documentation of the project including the documentation required for advance and retention payments, but also ensures the submission of those documents to the client in a timely manner.

Conclusion

Managing a project’s cashflow need not be difficult if the company invests in the right software, especially because in a project everything is interconnected with everything else and solving one payment bottleneck, no matter how large or small, will have a huge positive effect on the entire cashflow. In the next blogpost we will address ‘Prelims and Risk’. Stay tuned.

————————-

* The Royal Institution of Chartered Surveyors (RICS) is a professional organization that establishes and enforces standards for valuing, operating, and developing assorted types of property. RICS is one of the world’s leading professional bodies for qualifications and standards in land, property, and construction. Established in 1868 by a group of surveyors in London, RICS has spread to over 140 countries.